Razor and blades (Gilette, Wilkinson). Printer and toner (HP). Instrument and consumables (Applied Biosystems). Aircraft engines and service (GE, Rolls-Royce). Smartphone and data usage / call minutes (Verizon, Vodafone). Each of these is an example of a business where building an installed base is key, as the subsequent service revenue (in the broad sense of the word) is both lengthy in duration as well as highly profitable. Some companies make significant business concessions in pricing of the former (the “equipment”) to get access to the latter (the “service”). It might even be a rational economic decision to sell the equipment at a loss, provided the service revenue and profit stream is captive and customers cannot easily switch to other service providers. Alternatively, a structure where a customer gets a longer term free-of-charge use of a piece of “demo equipment”, but pays for the consumables, could make sense.

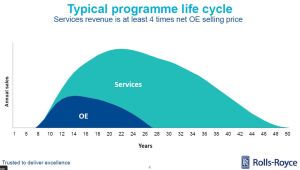

Rolls-Royce provided a nice rule-of-thumb chart in its very informative investor briefing in June 2014: services revenue is at least 4 times net OE selling price over the lifecycle of an engine program. GE at the end of Q3 ’14 had a total backlog (orders committed, but not yet delivered) of $250B (!), of which $180B in services and $70B in equipment. Half of GE’s backlog is in the Aviation business. GE implicitly provided Operating Margin (EBIT) percentages (see my article on GE’s service versus equipment margins) for each type of business: equipment at around 10% OM, service at 30% (disclaimer: across GE’s broad industrial portfolio, not specifically for aircraft engines). Service proves to be an attractive revenue and profit generator for both these companies.

Which indicators should we track to measure the service business’ earnings potential?

It’s important to have estimates of how the installed base of a company’s equipment placed with customers will develop. The potential for service revenue then depends on the usage of the equipment and the contractual structure of the service agreement. In the aviation business, billing for engine service contracts tends to be based on hours flown times rate per hour. Therefore, RPK (Revenue Passenger Kilometers) or RPM (Revenue Passenger Miles) are key indicators for companies like Rolls-Royce and GE, and often mentioned on the first page of investor briefings and earnings releases. If RPK/RPM goes up or down, it has a significant impact on the most profitable part of their business!