In terms of products and technology, oil and telecom companies are very different: finding, extracting and refining vast amounts of oil products, versus transmitting, securing and storing vast amounts of data. No overlap between these industries at all, at first glance. However, when you review the cash flow statement of companies in these respective industries, you find striking similarities. Let’s take Shell (the British-Dutch oil company) and Verizon (US-based telecom and networks company) as examples. Similar characteristics apply to their industry peers like BP and AT&T.

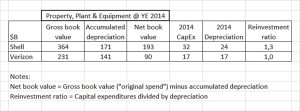

Both Shell and Verizon are very capital-intensive companies. They have huge amounts of fixed assets (property, plant and equipment) on their balance sheet: Shell at $193B net book value per year-end 2014, and Verizon at $90B. To add to that, both companies have significant capital expenditures (CapEx, fixed asset investments during the year), which is a huge cash outflow every year. For Shell $32B of capital expenditures in 2014, and Verizon $17B.

Both Shell and Verizon are very well known and respected as high dividend yield companies. They have a reputation for being highly dependable for paying quarterly dividends in cash to their shareholders, which appeals to large groups of investors, versus a share price that is fairly stable with few variations and hardly ever any dramatic surprises (positive, or negative). The very large dividend payments of $9B for Shell in 2014 and $5B for Verizon (and occasional share repurchases in times of excess cash) create a very significant annual cash outflow.

Where do these companies get the cash inflow to finance the capital expenditures cash outflow and the dividend cash outflow? Until recently, both Shell and Verizon were blessed with a very healthy inflow of cash from operating activities of $45B and $31B respectively (roughly: customers paying the company, minus what the company pays in salaries to employees, invoices to suppliers and taxes to the government), which easily covered the cash from investing and cash from financing activities outflow.

All was well in the oil industry until 2015. Then, oil prices continued to drop dramatically (from an average of $100 per barrel in 2014 to $55 in the first months of 2015), which hurts the operational cash flow at oil companies hard. In Shell’s case, every change of $10 in the oil price impacts cash flow by $3.3B.

All was well in the telecom and network industry until 2015. Then, the auction of spectrum licenses in the US (enabling the next generation of wireless technology) turned out to be a very competitive event, with AT&T spending $18B and Verizon $10B. Not everyday expenses, and not an amount of cash that even a large and cash rich company like Verizon has lying around (well, unless you want to completely deplete your cash balances, which is not advisable as you have no money left for business continuity, i.e. to pay your employees and suppliers, and continue your investments).

So how have Shell and Verizon “solved” their cash flow problem in 2015? Neither company wanted to cut its dividends (cash payments to shareholders), as this would hurt its reputation as a predictable and dependable dividend paying stock. Neither company wanted to significantly restrict its spending on capital expenditures, as investing less now would hurt its ability to compete in the future. Shell has significant borrowing capacity and a AA/Aa1 rating, and can easily borrow an incremental ten billion GBP at very favorable interest rates (which it has done), while Verizon is fairly “maxed out” on borrowing (with a BBB+ rating) after its purchase of the Vodafone share in its wireless business in 2014 (raising $49 Billion in the largest corporate-bond sale ever, as one of the ways to finance the $130B deal). Both Shell and Verizon are selling off non-core assets, in the case of Verizon $15B in two major transactions in early 2015.

In every company around the world, the cash needs to flow. Without cash, it’s game over, and as existentialist philosophers have correctly remarked “existence precedes essence”. What can we learn from the oil and telecom industries? In industries where companies need to continue to invest very significantly every year in order to build capacity and/or a technological competitive advantage, and investors are conditioned to expect large stable dividend payments, you need to generate incoming cash flow to keep operating. You can either borrow more (to a limited extent) to finance your business, sell assets (to a limited extent) to free up cash, or most importantly maximize the operational cash flow by improving profitability, and managing working capital (receivables, inventory, payables) carefully. If you want to know which decisions a company is making, what the sources and uses of its cash are, then watch its cash flow statement carefully. It is vastly underrated versus its more popular next of kin, the income statement.

One reply on “Oil and telecom… very similar!”

Nice article. Cash should keep flowing to ensure having business continuity