Video #11 in the Finance Storyteller series, one that affects business travel in many corporations: the Q4 travel freeze! Is it worth implementing it, to emphasize cost-consciousness? Or does it do more harm than good? Find out the pros and cons in the video below.

Category: Business

I am sharing samples of my work: stories I tell during the training courses I deliver. This blog also serves as a “further reading” opportunity for participants. The “Business” section is all around strategy, entrepreneurship and business models.

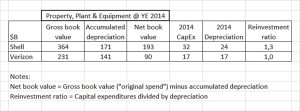

In terms of products and technology, oil and telecom companies are very different: finding, extracting and refining vast amounts of oil products, versus transmitting, securing and storing vast amounts of data. No overlap between these industries at all, at first glance. However, when you review the cash flow statement of companies in these respective industries, you find striking similarities. Let’s take Shell (the British-Dutch oil company) and Verizon (US-based telecom and networks company) as examples. Similar characteristics apply to their industry peers like BP and AT&T.

Both Shell and Verizon are very capital-intensive companies. They have huge amounts of fixed assets (property, plant and equipment) on their balance sheet: Shell at $193B net book value per year-end 2014, and Verizon at $90B. To add to that, both companies have significant capital expenditures (CapEx, fixed asset investments during the year), which is a huge cash outflow every year. For Shell $32B of capital expenditures in 2014, and Verizon $17B.

Both Shell and Verizon are very well known and respected as high dividend yield companies. They have a reputation for being highly dependable for paying quarterly dividends in cash to their shareholders, which appeals to large groups of investors, versus a share price that is fairly stable with few variations and hardly ever any dramatic surprises (positive, or negative). The very large dividend payments of $9B for Shell in 2014 and $5B for Verizon (and occasional share repurchases in times of excess cash) create a very significant annual cash outflow.

Where do these companies get the cash inflow to finance the capital expenditures cash outflow and the dividend cash outflow? Until recently, both Shell and Verizon were blessed with a very healthy inflow of cash from operating activities of $45B and $31B respectively (roughly: customers paying the company, minus what the company pays in salaries to employees, invoices to suppliers and taxes to the government), which easily covered the cash from investing and cash from financing activities outflow.

All was well in the oil industry until 2015. Then, oil prices continued to drop dramatically (from an average of $100 per barrel in 2014 to $55 in the first months of 2015), which hurts the operational cash flow at oil companies hard. In Shell’s case, every change of $10 in the oil price impacts cash flow by $3.3B.

All was well in the telecom and network industry until 2015. Then, the auction of spectrum licenses in the US (enabling the next generation of wireless technology) turned out to be a very competitive event, with AT&T spending $18B and Verizon $10B. Not everyday expenses, and not an amount of cash that even a large and cash rich company like Verizon has lying around (well, unless you want to completely deplete your cash balances, which is not advisable as you have no money left for business continuity, i.e. to pay your employees and suppliers, and continue your investments).

So how have Shell and Verizon “solved” their cash flow problem in 2015? Neither company wanted to cut its dividends (cash payments to shareholders), as this would hurt its reputation as a predictable and dependable dividend paying stock. Neither company wanted to significantly restrict its spending on capital expenditures, as investing less now would hurt its ability to compete in the future. Shell has significant borrowing capacity and a AA/Aa1 rating, and can easily borrow an incremental ten billion GBP at very favorable interest rates (which it has done), while Verizon is fairly “maxed out” on borrowing (with a BBB+ rating) after its purchase of the Vodafone share in its wireless business in 2014 (raising $49 Billion in the largest corporate-bond sale ever, as one of the ways to finance the $130B deal). Both Shell and Verizon are selling off non-core assets, in the case of Verizon $15B in two major transactions in early 2015.

In every company around the world, the cash needs to flow. Without cash, it’s game over, and as existentialist philosophers have correctly remarked “existence precedes essence”. What can we learn from the oil and telecom industries? In industries where companies need to continue to invest very significantly every year in order to build capacity and/or a technological competitive advantage, and investors are conditioned to expect large stable dividend payments, you need to generate incoming cash flow to keep operating. You can either borrow more (to a limited extent) to finance your business, sell assets (to a limited extent) to free up cash, or most importantly maximize the operational cash flow by improving profitability, and managing working capital (receivables, inventory, payables) carefully. If you want to know which decisions a company is making, what the sources and uses of its cash are, then watch its cash flow statement carefully. It is vastly underrated versus its more popular next of kin, the income statement.

Ancient business wisdom says “What gets measured gets done”. Business leaders and financial executives have used this heuristic to design and implement key performance indicators that link to the company’s strategy. A related rule of thumb is that it’s only fair to measure people on things they can influence.

But does and should the opposite also apply? “What does not get measured, does not get done”? Logically speaking, maybe that should be the case, and many employees seem to implicitly use this statement to justify not taking certain actions (“if it is not measured, then it doesn’t help me on my performance review, or get me a bigger bonus, and it isn’t worth doing”). However, this assumes that the key performance indicators have been correctly chosen by the company, are fair indicators of the company’s success, and that everything that is truly important can be (numerically) measured.

In my view, we should look to moral philosophy for guidance, rather than business literature. Jeremy Bentham and John Stuart Mill held the view that “the moral worth of an action is determined by its outcome” (utilitarianism, consequentialism). Immanuel Kant disliked this utilitarian approach, as good consequences could arise by accident from an action that was motivated by a desire to cause harm to an innocent person, and bad consequences could arise from an action that was well-motivated. Instead, Kant proposes to focus on principles: “There are principles that are intrinsically valid; they are good in and of themselves; they must be obeyed in all, and by all, situations and circumstances”.

Based on Kant’s principle-based ethics, I would reject the “What does not get measured, does not get done” viewpoint. Some fundamental principles of doing the right things (leadership), doing things right (execution excellence) and doing right (integrity), cannot necessarily be fully measured by key performance indicators in a utilitarian way. There’s definitely a context to what we do in business….

Culture matters. A lot. Our cultural background shapes the way we view the world, what we find “normal” or “strange”. Cultural biases are very strong in human beings, though they can be overcome by awareness and appreciation of other cultures, through travel and exposure to alternative ways of viewing the world.

Culture even plays a very big role in the financial reporting of companies. And not just in the “technical”/numerical sections, where how we keep the score is influenced by the rules and principles we apply to the calculation (US GAAP used in the US, IFRS used in 120+ countries globally, or “local GAAP”). Each of these accounting frameworks for reporting to the stock market has its own definitions and calculations of metrics such as “profit”. These might be similar in many cases, but are not fully identical.

Culture is much more evident in the “branding” and contextual sections of the annual report, such as the title that is chosen for an annual report, or the messages from the senior leadership in the “letter to the shareholders”.

Both in my years as an employee, as well as in those as a trainer and external consultant, I have mostly worked for global companies with American roots. I like the optimism, forward-looking orientation, and passion to “dream big” that is embedded in American culture. It shines through in the annual report: much of what the CEO is sharing (in the letter to the shareholders) is about the initiatives the company is implementing, the market opportunities it is pursuing, and the great future that is ahead of us. Some time is spent on recent results, but looking back at last year is mostly done in the “Management’s Discussion and Analysis (MD&A)” section, which is much further down the annual report (the smaller font “technical” section that fewer readers get to).

If we then turn to the annual report of a British company, we will find a Chairman’s Review and a Chief Excecutive’s Review (reflecting the two-tier structure in the UK, versus the Chairman-CEO single point of power in the US) that largely deal with last year’s performance, with possibly a little reference to what this means for the future of the company. The tone of these is much more modest, at times even apologetic, versus their more optimistic or even aggressive US counterparts.

The most overly optimistic annual report title (versus the actual financial results) I have ever seen was in the midst of the financial crisis, in the Caterpillar 2009 annual report: the title “How we win” suggests that the company has done very well, while the financial overview shows a 37% drop in revenues versus the prior year, and a whopping 75% (!) drop in profitability versus prior year. Caterpillar is a global company with clear American roots. Worth going beyond the cover page and the impressive marketing/branding efforts on people and products, to get a more holistic view once you go through the key financials (revenue, operating margin, cash flow from operating activities).

It’s worthwhile to review a company’s annual report, as a shareholder, employee, customer, or supplier. But before you dive in, ask yourself what the context is of the (narrative or financial) messages you are looking at!

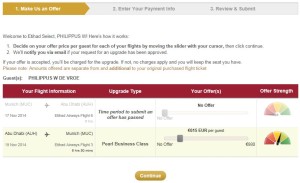

While other airlines only send lame e-mails with offers to book a car or hotel connected to your flight, Etihad has a more exciting question: would you like to bid for an upgrade to business class? If you bought an economy class ticket, Etihad will “auction” upgrades to business class for each leg of your journey. The process is in three easy steps: make an offer using a slider that indicates the offer strength, enter credit card details, review and submit. The airline will then notify you via e-mail if the upgrade request has been approved (and only then charge you).

Easy to use, and I would gladly participate if I could make a token low bid of let’s say €100 or €200 with a 10% or 20% probability that I would be lucky enough to get a seat. In other words, a “small investment, huge pay-off” bet. An offer strength indicator indicates the range of past successful offers for similar flights. Unfortunately, in my case, the slider tool does not allow a bid below €560 per leg, which would get me into the “red” category (this translates to me as: unlikely to be accepted). Starting at €595, you get into the “yellow” category (suggesting you have some chance of acceptance), and starting at €765 you are in solid dark “green” (suggesting it is highly likely that the bid will be accepted).

Frequent travelers have posted tips for successful bidding on the internet, such as:

- Look at what it would cost you to purchase the business class fare

- Bid slightly over the minimum bid

- Check how full the flight is. Make a pretend booking online, in both business and economy, so you can get to see the seat map for each cabin. If business class if empty your chances of an upgrade are good. If economy class is super full, your chances of an upgrade are quite good as airlines overbook flights all the time so freeing up your economy class seat could help.

- Decide what the upgrade is worth to you.

- The kind of ticket you purchase may matter.

- Your frequent flyer status with the airline may count.

Given that my original economy ticket was €988 roundtrip, I am not feeling I get a good “deal” here, as an economy ticket plus two upgrade bids would not be significantly cheaper than booking a business class ticket from the start.

In short: I love the concept, a nice incremental business model that could generate a good amount of additional revenue for Etihad by getting already “captive” economy passengers into those empty business class seats, but the deal has to make the customer feel he “wins” as well versus walking up to the ticket desk at the airport and buying an upgrade there.

Service as the key to success

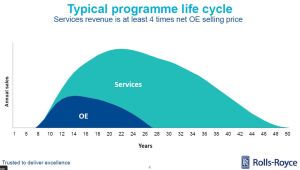

Razor and blades (Gilette, Wilkinson). Printer and toner (HP). Instrument and consumables (Applied Biosystems). Aircraft engines and service (GE, Rolls-Royce). Smartphone and data usage / call minutes (Verizon, Vodafone). Each of these is an example of a business where building an installed base is key, as the subsequent service revenue (in the broad sense of the word) is both lengthy in duration as well as highly profitable. Some companies make significant business concessions in pricing of the former (the “equipment”) to get access to the latter (the “service”). It might even be a rational economic decision to sell the equipment at a loss, provided the service revenue and profit stream is captive and customers cannot easily switch to other service providers. Alternatively, a structure where a customer gets a longer term free-of-charge use of a piece of “demo equipment”, but pays for the consumables, could make sense.

Rolls-Royce provided a nice rule-of-thumb chart in its very informative investor briefing in June 2014: services revenue is at least 4 times net OE selling price over the lifecycle of an engine program. GE at the end of Q3 ’14 had a total backlog (orders committed, but not yet delivered) of $250B (!), of which $180B in services and $70B in equipment. Half of GE’s backlog is in the Aviation business. GE implicitly provided Operating Margin (EBIT) percentages (see my article on GE’s service versus equipment margins) for each type of business: equipment at around 10% OM, service at 30% (disclaimer: across GE’s broad industrial portfolio, not specifically for aircraft engines). Service proves to be an attractive revenue and profit generator for both these companies.

Which indicators should we track to measure the service business’ earnings potential?

It’s important to have estimates of how the installed base of a company’s equipment placed with customers will develop. The potential for service revenue then depends on the usage of the equipment and the contractual structure of the service agreement. In the aviation business, billing for engine service contracts tends to be based on hours flown times rate per hour. Therefore, RPK (Revenue Passenger Kilometers) or RPM (Revenue Passenger Miles) are key indicators for companies like Rolls-Royce and GE, and often mentioned on the first page of investor briefings and earnings releases. If RPK/RPM goes up or down, it has a significant impact on the most profitable part of their business!

The beauty of the British Pound

A short reflection on the beauty of the British Pound.

Well, not really on the currency itself: I used to encourage the Brits to actually give up the British Pound and join the Euro, as their economy is closely interrelated with that of the rest of Europe and a joint currency might facilitate trade, but after studying the great works of Nassim Taleb (“The Black Swan”, “Antifragile”) I have become more skeptical about fragile complex systems we do not understand (like the Euro) that might have many unwanted side effects. So let me proclaim myself to be an agnostic on the question whether the Brits should continue to use the British Pound.

Rather, I would like to reflect in this article on the beauty of the British Pound banknotes, in particular the back side of them. Each is graced with a portrait of a great British scholar: the £10 note with Charles Darwin (1809-1882), and the £20 note with Adam Smith (1723-1790). I am disappointed that Smith got to be on the £20 note and Darwin “only” got the £10 note, as I deem the scientific impact and reach of Darwin’s ideas far more noteworthy than those of Smith (even though I studied economics myself, rather than biology). Not only does Adam Smith get to be on a note of higher nominal value, there are also many more £20 notes (1.8 billion) than £10 notes (700 million) in circulation. So who wins the popularity contest? I think neither of them would have cared, if they were still alive. The amusing thing is that Adam Smith was a Scottish economist, the first Scot to appear on an English note.

The beauty of having these two scholars on the British Pound notes is that they teach us a similar concept: Darwin’s discovery of the mechanisms underlying evolution, and Smith’s discovery of the mechanisms of wealth creation. To simplify and summarize matters greatly: one of Darwin’s key propositions is that those organisms that are best adapted to their environment have greater chances of survival, one of Smith’s is that division of labour in manufacturing causes a great increase in the quantity of work that results. In short: adaptation and specialization, concepts that have significant applicability in the area of business strategy, as well as career planning. Are you (and/or your company) working on those things that you are technically competent at, that you enjoy doing, and that pay reasonably well? If so, your earnings potential, your job satisfaction, and “chances of survival” (in a dynamic and turbulent economy, with lots of companies going bankrupt, and jobs under threat of restructuring) are likely to be higher. Those are the questions that I contemplate every time I have British Pound banknotes in my hands. Good triggers for reflection. I am lucky to visit the UK on a regular basis, and use its analogue currency whenever I can. Adam Smith will be around on the £20 note for many more years, as “his” £20 note was issued in 2007 as part of “Series F”. Charles Darwin will sadly be replaced by Jane Austen in 2017 on the £10 note, but has had a long run in circulation since 2000.